Do You Truly Know What Your House Could Be Worth?

Want to know something important that most people don’t check as often as they should? Here's a hint: it’s your home’s value.

The truth is, your house is probably your largest financial asset. And if you’ve owned it for several years, it’s likely been gaining value behind the scenes — even if you haven’t been paying close attention.

With recent changes in the market, you might be surprised at how much equity you’ve built up.

What Is Home Equity?

That untapped wealth in your home? It’s called equity. Equity is the difference between your home’s current market value and the remaining balance on your mortgage. It grows over time as property values increase and as you continue to pay down your loan.

Here’s a simple example:

If your home is worth $500,000 today and you still owe $200,000 on your mortgage, you’ve built up $300,000 in equity. That’s pretty close to what the average homeowner currently has.

According to Cotality, the average homeowner with a mortgage has about $302,000 in equity.

Your Home Equity Could Be Higher Than You Expect

Wondering why your home equity might be higher than ever? Here are the top two reasons:

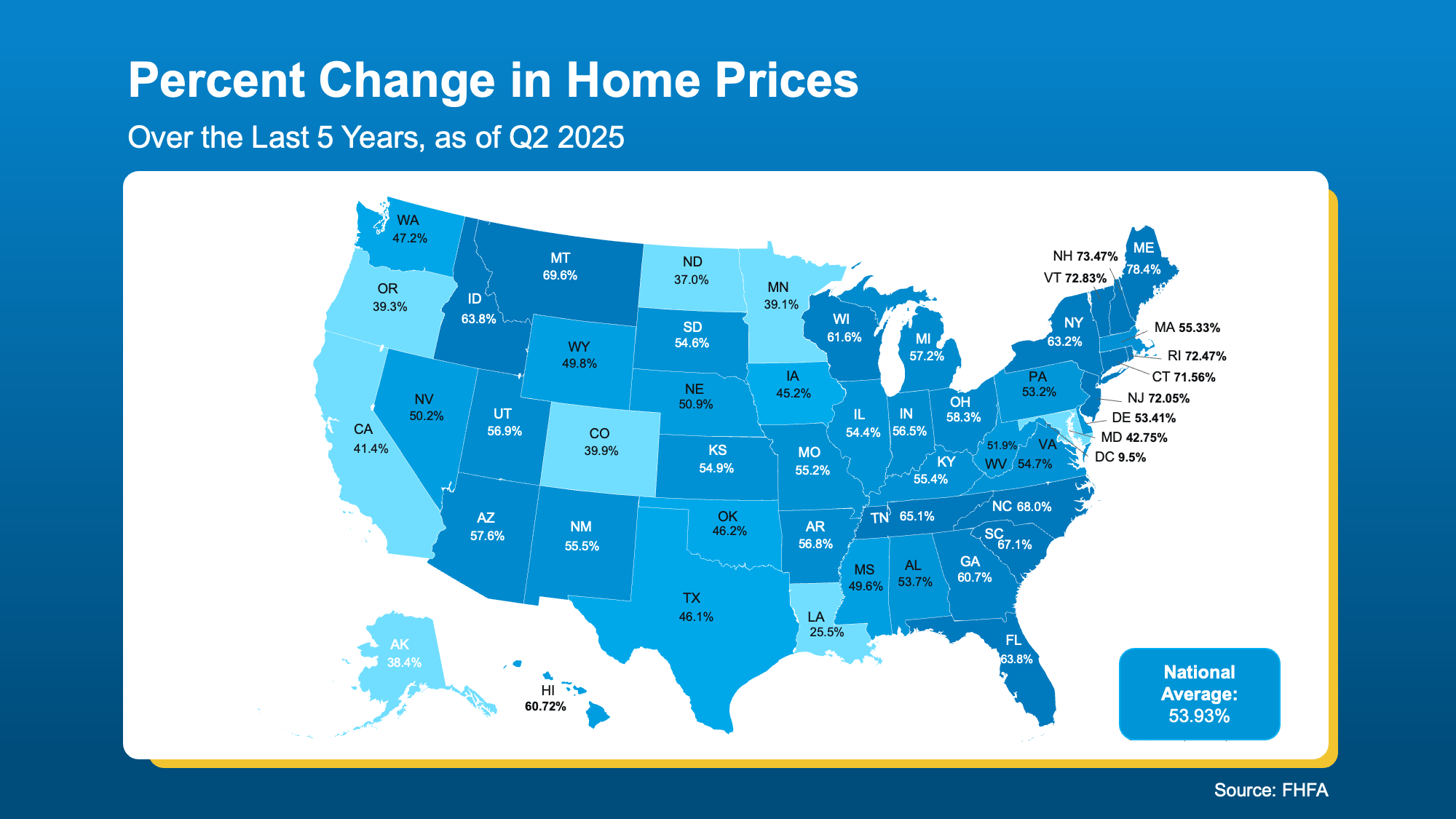

1. Significant Home Price Growth. According to the Federal Housing Finance Agency (FHFA), home prices have jumped by nearly 54% nationwide over the last five years (see map below):

That means your home is probably worth significantly more today than when you first purchased it, thanks to steady price growth over the years. And even if you’ve heard that prices are starting to level off — or dip in some areas — don’t worry. If you’ve owned your home for several years, chances are you’ve built up enough equity to sell and still walk away with a solid profit.

That means your home is probably worth significantly more today than when you first purchased it, thanks to steady price growth over the years. And even if you’ve heard that prices are starting to level off — or dip in some areas — don’t worry. If you’ve owned your home for several years, chances are you’ve built up enough equity to sell and still walk away with a solid profit.

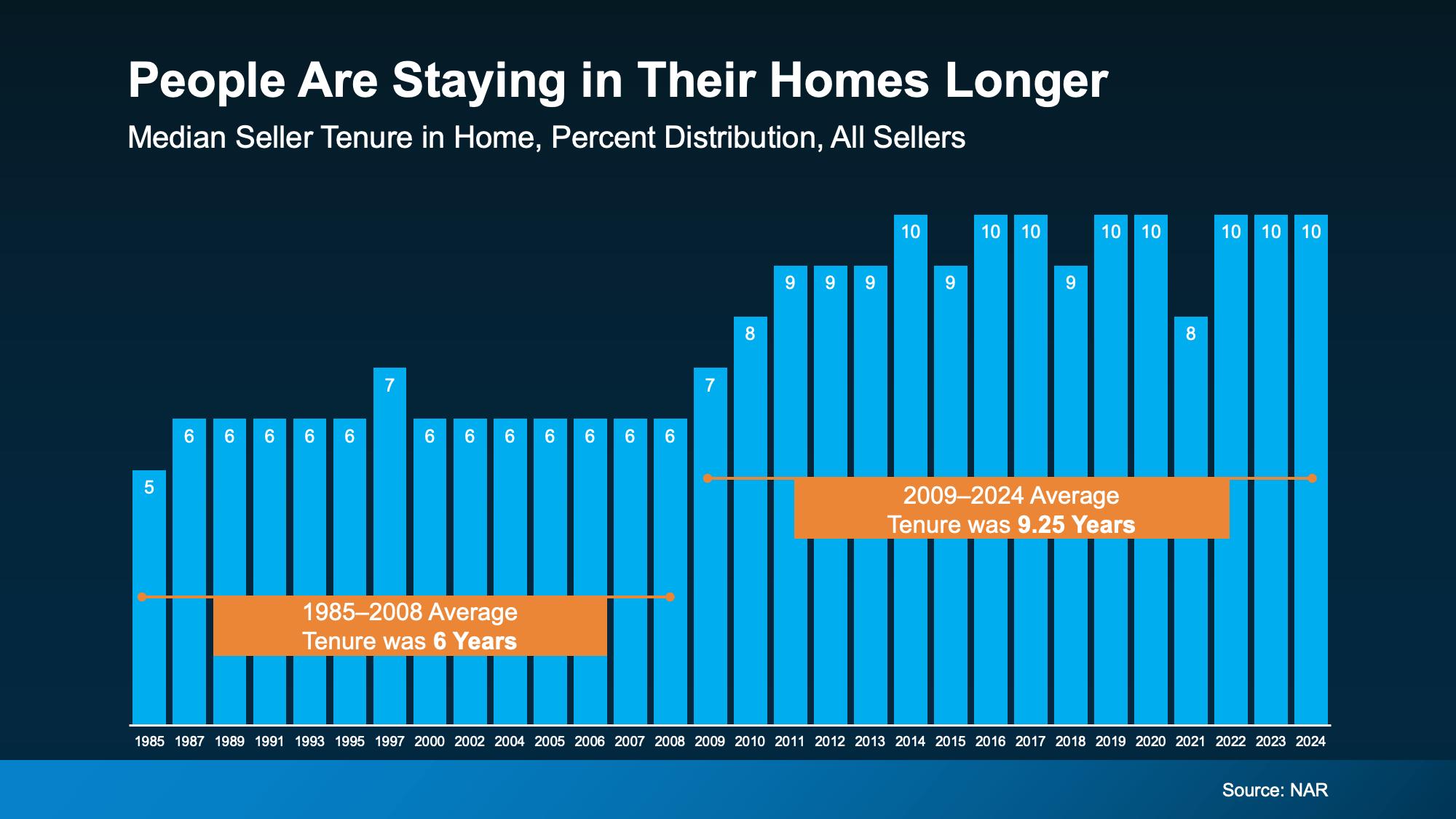

2. People Are Living in Their Homes Longer. Data from the National Association of Realtors (NAR), shows the average homeowner stays in their home for about 10 years now (see graph below):

That’s a longer stretch than it used to be — and over that time, you’ve built equity simply by making your mortgage payments and benefiting from rising home values. The truth is, homeownership is a long-term game. It’s not about short-term market shifts, but steady growth over time. And if you’ve stayed in your home for a few years, that strategy has likely paid off.

So, just how much has that quiet price appreciation worked in your favor? According to NAR:

“Over the past decade, the typical homeowner has accumulated $201,600 in wealth solely from price appreciation.”

What Could You Actually Do with That Equity?

Your equity isn’t just a number on paper — it’s a powerful financial resource that can help you take your next big step. Depending on your goals, here are a few smart ways to put it to work:

-

Buy your next home: You can use your equity toward the down payment on a new house. In some cases, it might even be enough to buy your next place with all cash — giving you a major advantage in today’s market.

-

Upgrade your current home: Use your equity to fund renovations that make your home better suited to your lifestyle. And if you choose projects with high return on investment, you could increase your home’s value even more down the line.

-

Launch your dream business: Equity can be a great source of funding for startup costs, equipment, or marketing. It’s a way to invest in your future and potentially boost your long-term earning power.

Key Takeaways

Chances are, your home has gained significant value. If you’re curious about how much it’s worth today, let’s connect. I’ll provide you with a personalized Equity Assessment Report, so you’ll have a clear picture of your home’s value — and a better understanding of your options moving forward.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "